2018 Gainesville-Alachua County Real Estate Review

I hope this analysis provides you with information that will both educate and prepare you to make the best real estate decisions possible in 2019. Data presented were accumulated from the GACAR MLS, FloridaRealtors.org, US Census Bureau and the Alachua County Building Department through 12/7/17. Some of these statements are forward-looking and actual results may differ materially.

Prices Rise in Alachua County as Affordability Fades.

Is a Sales Pause Upon Us?

As 2018 wanes to a close, sagacious investors, prospective purchasers and homeowners alike find themselves wondering what is in store in the annum ahead for the Alachua County real estate market. Local condo and single family home values were buoyed on the back of an approximately 7-9% rise in value this year. Tidings like these would typically be celebrated with good cheer but many amongst us lament the fact that interest rates are rising, subcontractors are scarce, construction costs continue to ascend and there are murmurs of a slowdown in local sales. Throw in the ubiquitous refrain from the national media of, “tariffs, trade wars and stock market tumult”, and it is easy for anyone to feel anxious. Are these somber portents indicative of an impending collapse or does this bull market have room to run?

For the second straight year, the Alachua county housing market has shown a slight gain in the total number of houses sold.

TABLE 1–Residential Home Sales 2018 vs 2017 (Jan 1-Dec 7 each year)

| PRICE | 2018 Sales | 2017 Sales | % Change |

|---|---|---|---|

| $0-$100,000 | 227 | 324 | -30% |

| $100,001 – $200,000 | 997 | 1124 | -11% |

| $200,001 – $300,000 | 1004 | 872 | +15% |

| $300,001 – $400,000 | 409 | 332 | +23% |

| $400,001 – $500,000 | 159 | 142 | +12% |

| $500,001 – $600,000 | 77 | 75 | +3% |

| $600,001 – $700,000 | 36 | 36 | +0% |

| $700,001 – $1,000,000 | 53 | 46 | +15% |

| $1,000,001+ | 27 | 17 | +59% |

| TOTAL HOME SALES | 2989 | 2968 | +0.7 |

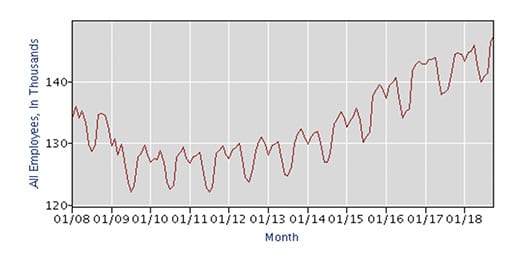

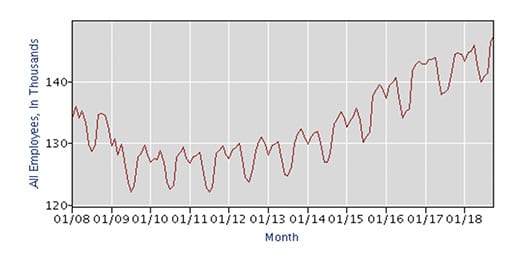

One might logically ask, if the number of sales are virtually the same since last year then why are values rising so fast? The answer is that limited housing supply and a growing population, fueled by strong job growth, are propelling demand. According to the US Department of Labor approximately 17,000 jobs have been created since our last employment trough in 2011 and 10,000 new jobs have been created since out last employment peak in 2008.

Alachua County Labor Market

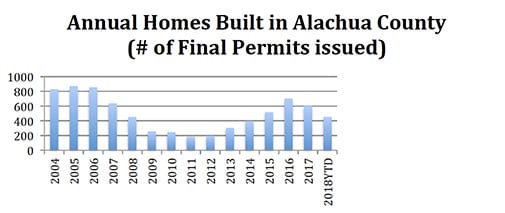

The U.S. Census Bureau estimates that the population in Alachua County has mushroomed by over 19,000 people from 2010 to 2017. The reason for the continuing escalation in housing prices is evident when one compares population size with home construction statistics. According to the Alachua County Building Department, since 2011, we have built approximately 3300 new homes. There is simply not enough reasonably priced housing supply to meet the demands of our burgeoning populace.

The link below is to a study published by Harvard University that provides intriguing support for those who believe that our local market may have further room to run despite periodic pauses or weakness in sales.

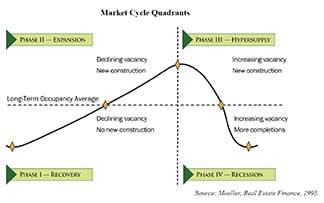

Glen R. Mueller developed the illustration above to demonstrate the routine and often predictable nature of local and national real estate cycles. In Alachua County our vacancies have been declining for many years, rental rates and sales prices have been ascending gratuitously since 2012 and supply has been extraordinarily low. These features are emblematic of Phase II in the real estate cycle also known as “Expansion”. Since new development often requires lengthy periods of time for evaluation, land acquisition, zoning and permitting, new supply often lags the demand in this phase by as much as 5-7 years. As a market enters Phase III, hyper-supply, values often continue to rise. As long as occupancy remains above the long-term average new development is financially feasible and profitable. The indicators of trouble occur when unsold inventory and vacancy rates begin to ascend, occupancy falls and rising interest rates manifest themselves. In Alachua County we are most definitely not experiencing a rise in vacancy rates or an excess of housing supply yet. We are however, seeing interest rates rise and this may be an early harbinger that the hyper-supply phase may be close at hand.

Could the rapid escalation in home prices over the past few years actually be having a negative effect on our market? It is entirely possible that present home values are squeezing out many eligible and motivated purchasers simply because they can no longer afford the cost of homeownership in Alachua County.

It seems almost counter-intuitive to believe that the number of new homes built has decreased over the past two years but it seems possible that the lack of affordability and low supply has pushed more residents into rentals and/ or multi-family apartments and condos. The visual evidence of new housing construction in Alachua County is easy to perceive. Many builders and developers throughout our area are presently clearing land, installing infrastructure and finishing new homes as they hasten to meet our excess demand. Even mass production, national builders such as Maronda Homes and D.R. Horton have initiated projects in Alachua County. A local representative from D.R. Horton informed this author last week that their goal is to complete over 400 homes a year in our area. According to the table above, based on data from the Alachua County Building Department, the annual construction rate of new homes in Alachua County has been between 300 and 700 units per year over the past five years. An infusion of hundreds more homes each year certainly has the potential to quench the present housing demand. The question is, how long will it take before we are oversupplied with homes that few can afford and are thereby pushed into the recession phase?

Conclusion

As 2019 commences, supply and demand continue to favor those who are selling property in Alachua County. Anecdotally though, the number of home sales in October and November 2018 appear to be lower than those in 2017. This softness may be attributed to increasing interest rates, decreasing affordability and the fact that the national and global financial bourses have been highly volatile thereby reducing buyer and consumer confidence. Occasional pauses and market slowdowns are inevitable and all expansions ultimately must meet their end. Whether the bull market in Alachua County real estate is near its demise or ramping up for the next leg up is certainly up for debate. At present, wise investors would do well to watch how much new home supply is built and how inventory and vacancy rates react during the next year or two.

Please contact me at [email protected] or (352) 262-2871 if you have any questions and if you are looking to sell a property then your optimum timeline for the best marketing starts now. I hope you have a fantastic 2019!

By Perry G. McDonald, Senior Vice President

Bosshardt Realty Services, LLC (352) 262-2871